Ultima Trading is an automated trading bot designed exclusively for spot trading on the ULTIMA/USDT pair. To start earning profit, you need to purchase a license and connect your MEXC account to the bot — it will then trade on your behalf using pre-set algorithms and generate profits for you.

The bot uses four trading strategies simultaneously: Price Breakout Strategy, GRID SHORT Strategy, GRID LONG Strategy, GRID DCA (Dollar Cost Averaging) Strategy.

These strategies are perfectly suited for all market conditions. In this guide, we’ll take a detailed look at each one.

PRICE BREAKOUT STRATEGY

- At the first launch, the bot executes a market buy using 50% of your package value and places a limit sell order at a price 5% higher than the purchase price.

- For example, if you’ve purchased a Basic-level bot license for 550 EUR (equivalent to 605 USDT), the bot will execute a purchase of 302.5 USDT. Let’s say the price of ULTIMA at the time of purchase is 10,000 USDT — the bot will then place a limit sell order at 5% above the purchase price, i.e., at 10,500 USDT.

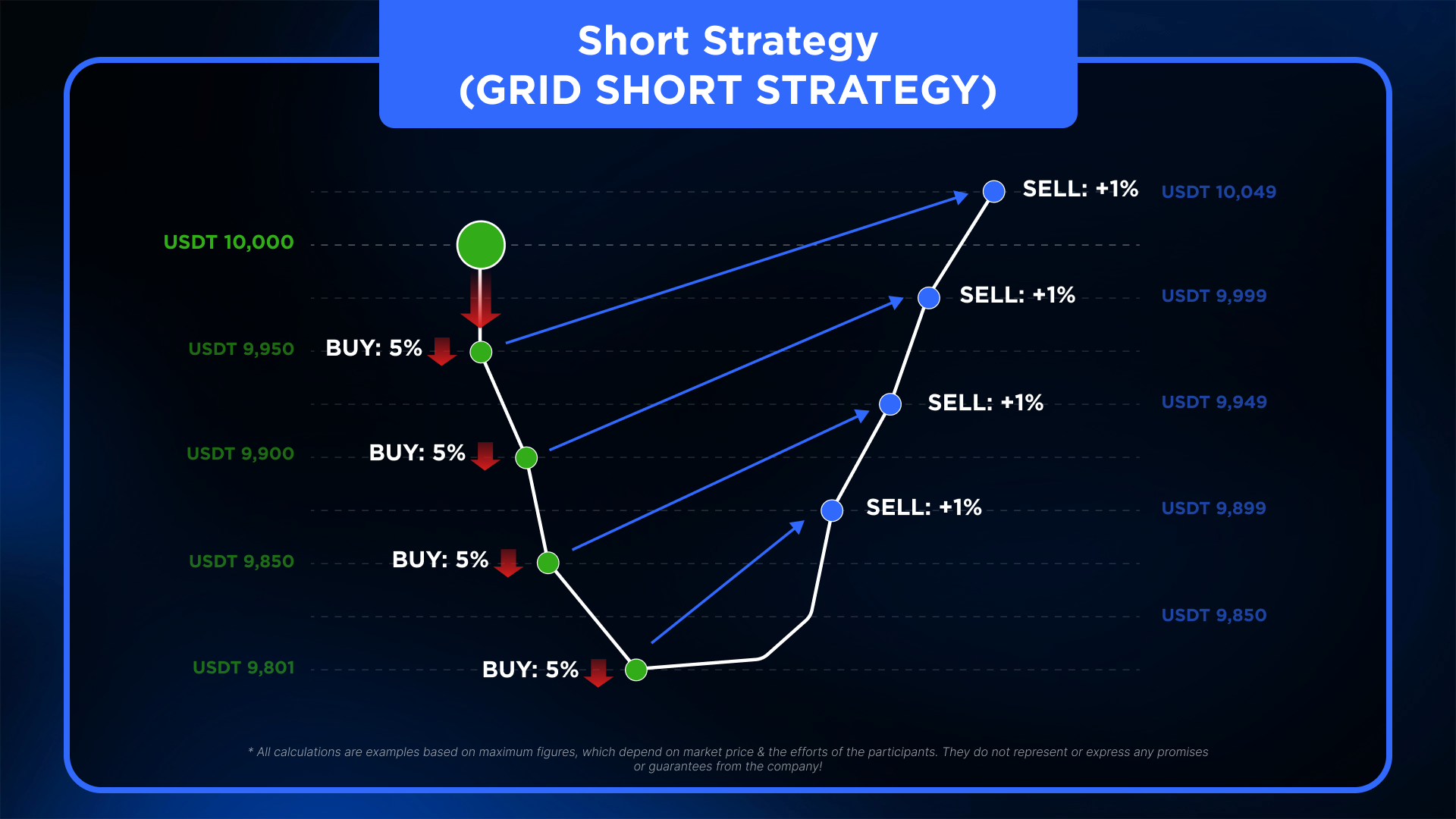

GRID SHORT STRATEGY

- When the price drops by 0.5% from the first purchase price, the bot makes a market buy for 5% of your package value. It then places a limit sell order for that 5% at 1% above the purchase price.

- If the price of ULTIMA drops more than 2.5% from the moment the bot was launched (i.e., the bot has already executed 5 consecutive purchases, each triggered by a 0.5% drop), then every 5th purchase will begin to double in volume.

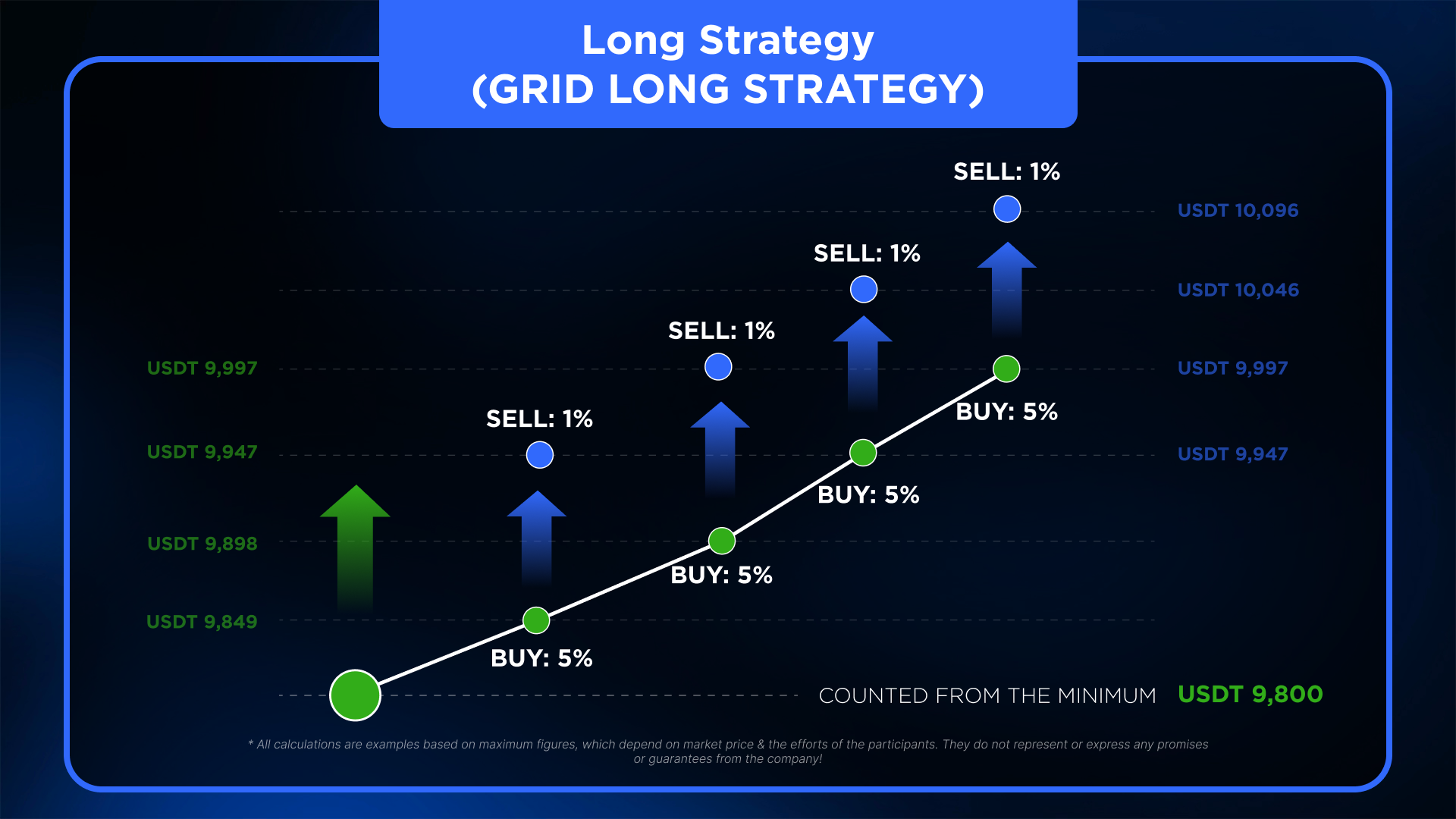

GRID LONG STRATEGY

- In a similar manner, when the bot is launched, the starting price is considered the current minimum. When the price increases by 0.5%, the bot executes a market buy using 5% of your package value, and places a limit sell order at 1% above the purchase price.

- Accordingly, if you have purchased a Basic-level bot license for 605 USDT, the bot will make a purchase of 30.25 USDT. Assuming the initial purchase was made at 10,000 USDT, then after a 0.5% price increase, the bot buys 30.25 USDT at the market price of 10,050 USDT and places a limit sell order at 10,150.5 USDT.

With each subsequent 1% price increase from either the minimum price or the last buy order (whichever is lower), the bot executes a new purchase using the same algorithm.

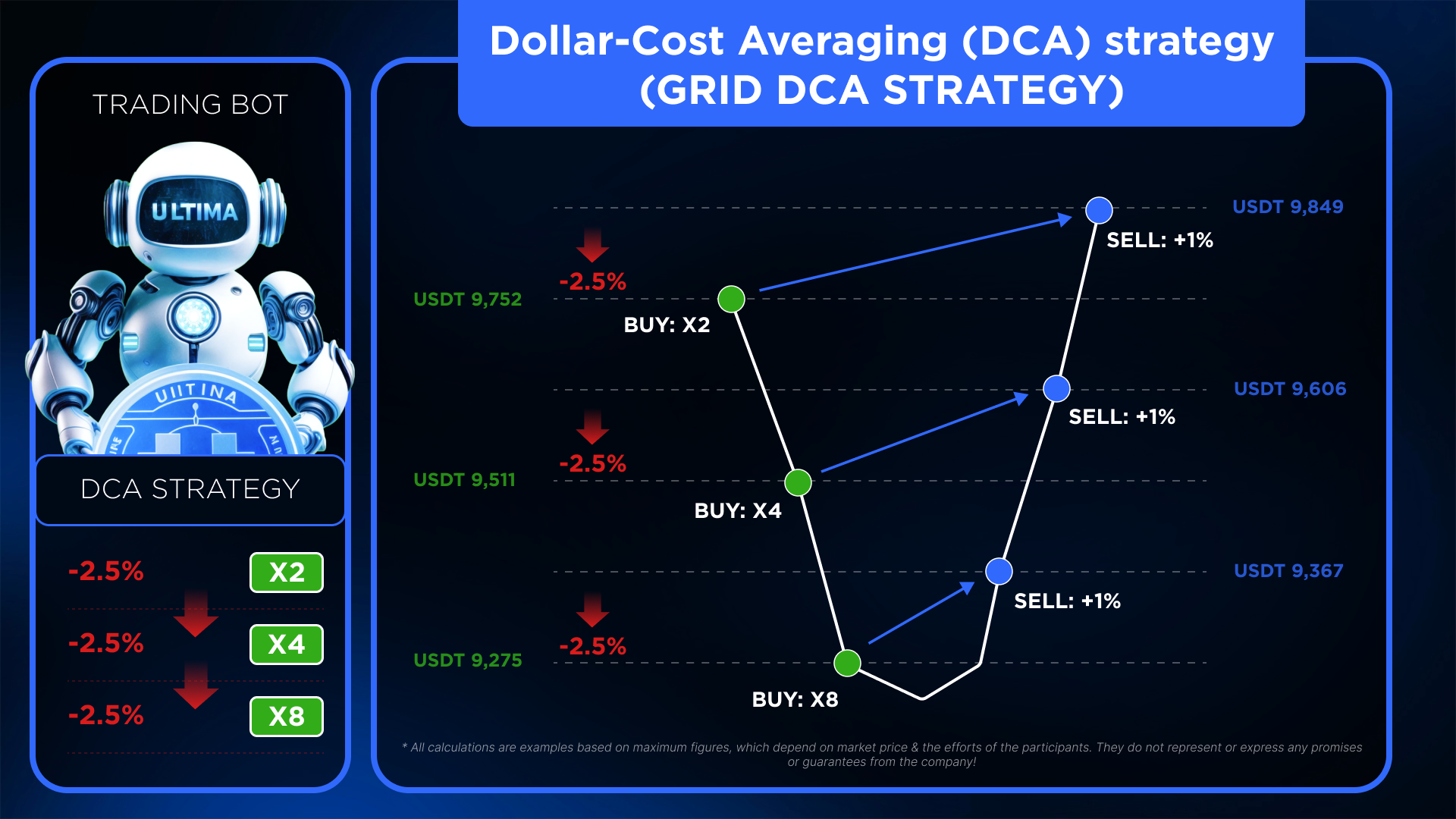

GRID DCA STRATEGY

If the price of ULTIMA continues to drop by more than 2.5% from the bot's launch price (meaning 4 consecutive buys have occurred, each after a 0.5% drop), every 5th buy after that will double in volume.

For example:

5th order – 10% of the package value

10th order – 20% of the package value

15th order – 40% of the package value

- So, if you have a Basic-level bot license worth 605 USDT, the 4th order will be 5% of the package, or 30.25 USDT. Starting with the 5th order, the bot will double the buy volume every 5 orders as long as the price continues to fall: 5th order → 60.5 USDT, 10th order → 121 USDT, 15th order → 242 USDT, and so on.

Important! Each subsequent order is based on the price of the last executed order. So, if the last buy was at an average price of 9,815 USDT, the next buy will be triggered after a 0.5% drop from 9,815 USDT.